For a more in depth look at your home please contact Steve Benson.

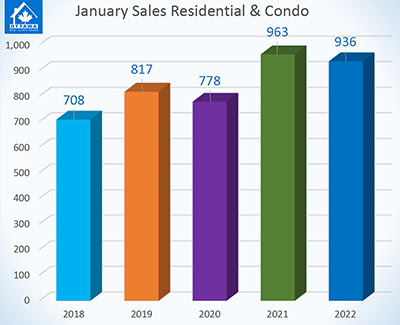

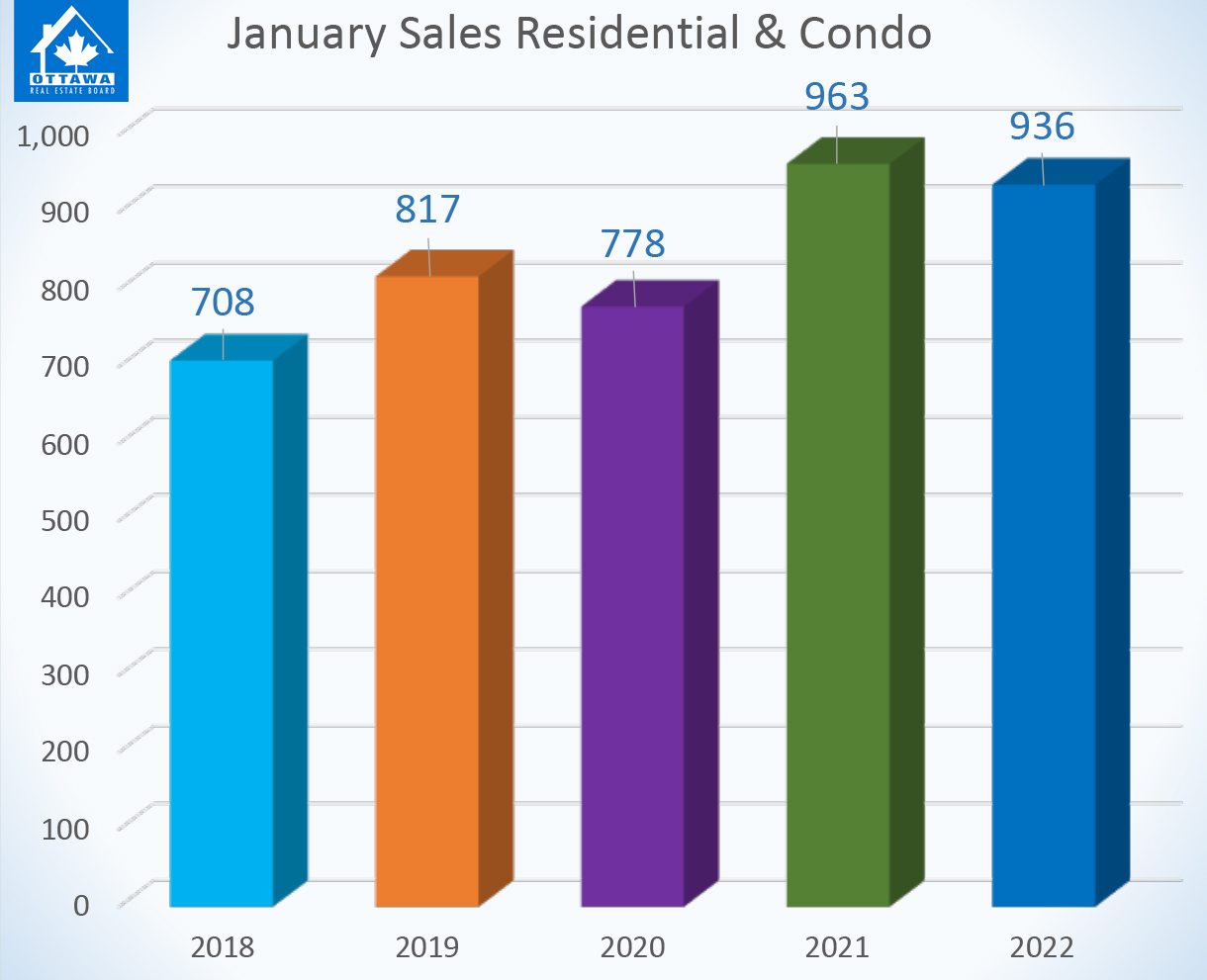

The Ottawa Resale Market Stats – January 2022

For a more in depth look at your home please contact Steve Benson.

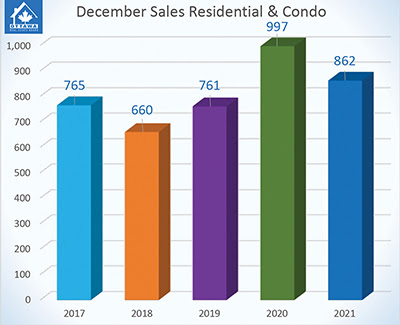

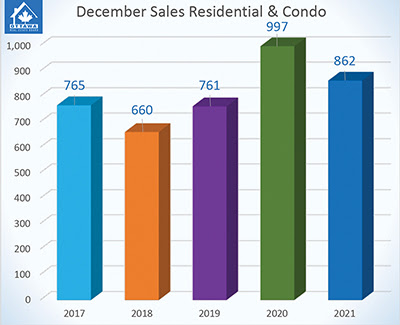

The Ottawa Resale Market Stats – December 2021

2021 Resale Market Normalizes and Breaks Records |

|

| Members of the Ottawa Real Estate Board sold 862 residential properties in December through the Board’s Multiple Listing Service® System, compared with 997 in December 2020, a decrease of 14 per cent. December’s sales included 601 in the residential-property class, down 15 per cent from a year ago, and 261 in the condominium-property category, a decrease of 10 per cent from December 2020. The five-year average for total unit sales in December is 809.

“December’s resale market performed as it typically does with a marked decrease in sales from November as families turned their attention towards the holiday break. Although slightly above the five-year average, the number of properties exchanging hands was lower than the year before due to the atypical market we experienced in 2020 when peak market activity shifted to later in the year because of the initial spring pandemic lockdown,” states Debra Wright Ottawa Real Estate Board’s 2021 President. “However, while the market normalized in the latter part of the year, looking at the year-end figures, 2021 was still a record-breaking year,” she adds.

The total number of residential and condo units sold throughout 2021 was 20,302, compared with 18,953 in 2020, increasing 7 per cent. Meanwhile, total sales volume in 2021 was approximately $13.1B compared to $10B in 2020. “This significant increase in sales volume reflects the price acceleration that we have seen over the last year and correlates with average sale price increases for the city,” Wright elaborates. “As we have reiterated for the past few years, Ottawa’s housing inventory challenges have been and will continue to place an upward pressure on prices. Reviewing the year-end figures for 2021, the average sale price year to date was $719,605 for residential-class properties and $419,683 for condominium units. These values represent a 24 per cent and 16 percent increase over 2020, respectively.” The average sale price for a condominium-class property in December was $399,125, an increase of 12 per cent from 2020, and the average sale price for a residential-class property was $709,980, increasing 18 per cent from a year ago.* “Six hundred new listings entered the housing stock in December, which represents a 58% decrease from November and down 15% from the 5-year average. At less than one month’s supply of units in both the residential and condominium property classes, we are firmly entrenched in a strong Seller’s market and will continue to be in this state until our inventory increases to a 3-4 month’s supply for a balanced market to be achieved,” cautions Wright. When asked for a forecast, Ottawa Real Estate Board’s new 2022 President Penny Torontow suggests, “January through March are usually slower months. With the macro factors that are currently at play in the resale market, it is difficult to predict what the effects will be going forward. We are entering yet another pandemic wave, Buyers are fatigued, parents are focusing on remote learning, interest rate hikes are looming – I don’t expect we will see the first quarter increases as we did in 2021.” “We are unlikely to see the true outcome of these macro factors until the spring. Presumably, we will see more of the same with the market performing as well as it can with the current housing stock. Unfortunately for homebuyers, it will sustain itself as a Seller’s market for quite some time until our inventory issues are remedied. Whether you are buying or selling a home right now, the experience and knowledge of a REALTOR® is essential in this current challenging market,” Torontow concludes. OREB Members also assisted clients with renting 4,813 properties since the beginning of the year compared to 3,364 in 2020. * OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood. |

For a more in depth look at your home please contact Steve Benson.

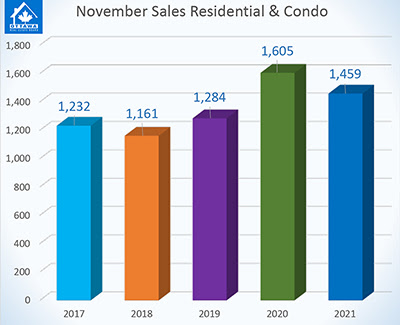

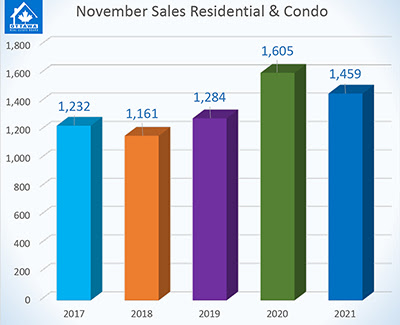

The Ottawa Resale Market Stats – November 2021

November’s Brisk Resale Market

Members of the Ottawa Real Estate Board sold 1,459 residential properties in November through the Board’s Multiple Listing Service® System, compared with 1,605 in November 2020, a decrease of 9 per cent. November’s sales included 1,086 in the residential-property class, down 10 per cent from a year ago, and 373 in the condominium-property category, a decrease of 7 per cent from November 2020. The five-year average for total unit sales in November is 1,348.

“Although the resale transactions in November were down compared to a year ago, this is because 2020’s peak market activity shifted to later in the year due to the initial pandemic lockdown. In reality, November’s unit sales tracked 14% higher than 2019 (1,284), a more relevant base year for comparison,” states Ottawa Real Estate Board President Debra Wright.

“Furthermore, the number of properties that changed hands in November was 8% higher than the five-year average. And we also see an 8% increase in year-to-date sales over 2020, so it is fair to say that the resale market remains active and brisk.”

The average sale price for a condominium-class property in November was $432,099, an increase of 19 per cent from 2020, and the average sale price for a residential-class property was $716,992, also increasing 19 per cent from a year ago. With year-to-date average sale prices at $719,956 for residential and $420,762 for condominiums, these values represent a 24 per cent and 16 percent increase over 2020, respectively.*

“Despite significant increases in average prices over November 2020, month-to-month price accelerations have tapered off slightly, with average prices for residential units on par with October’s and condo average prices increasing by 7%. This is a far better situation than the monthly price escalations we had seen in the first quarter of 2021,” suggests Wright. “However, there is no question that supply constraints will continue to place upward pressure on prices until that is remedied.”

“While the drop in volume of new listings is typical for November, our inventory, at one month’s supply, is much lower than it should be. 1,430 new listings entered the market last month, a 27% decrease from October (1,960) and 13% less than last November (1,635). While still 30 or so units over the five-year listing average, this is simply not sustainable and is taking us further away from the balanced market that will bring much-needed relief to potential Buyers,” Wright cautions.

“Whether you are on the buying or selling side of the transaction, this is not the occasion to go at it alone and hope for the best. An experienced REALTOR® is vital in navigating the challenges of this complex market to ensure you are making the optimal choices for what may be the most critical contract you will sign and remain obligated to for the next 20 to 30 years.”

OREB Members also assisted clients with renting 4,458 properties since the beginning of the year compared to 3,120 at this time last year.

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighborhood to neighborhood.

For a more in depth look at your home please contact Steve Benson.

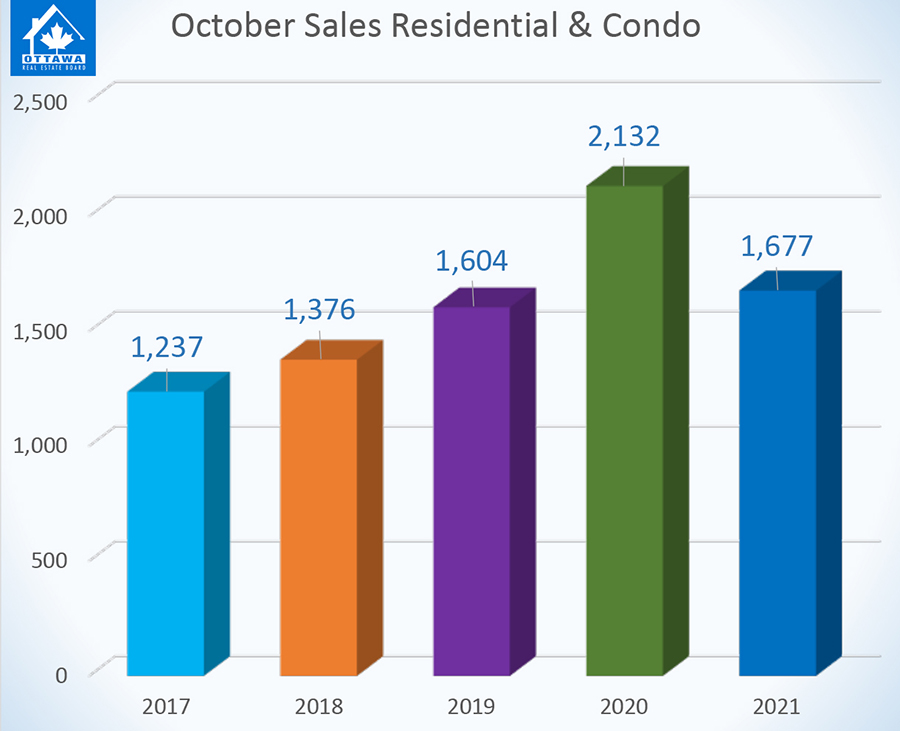

The Ottawa Resale Market Stats – October 2021

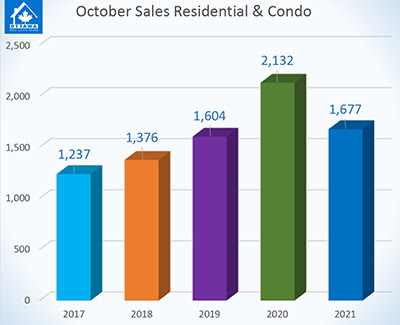

OTTAWA, November 3, 2021 – Members of the Ottawa Real Estate Board sold 1,677 residential properties in October through the Board’s Multiple Listing Service® System, compared with 2,132 in October 2020, a decrease of 21 per cent. October’s sales included 1,263 in the residential-property class, down 24 per cent from a year ago, and 414 in the condominium-property category, a decrease of 14 per cent from October 2020. The five-year average for total unit sales in October is 1,605.

“October’s resale market was active, busy, and stable – and followed the typical (pre-pandemic) ebb and flow that we commonly see as we enter the fall season,” states Ottawa Real Estate Board President Debra Wright. “The number of transactions increased slightly over September (1,607) as well as the 5-year average. The only reason we see a year-over-year decrease in comparison to last October is because 2020’s sales peak had shifted from the spring months to September/ October due to the initial Covid-19 lockdown.”

|

The average sale price for a condominium-class property in October was $404,760, an increase of 10 per cent from 2020, while the average sale price for a residential-class property was $716,378, an increase of 19 per cent from a year ago. With year-to-date average sale prices at $720,150 for residential and $419,515 for condominiums, these values represent a 24 per cent and 16 percent increase over 2020, respectively.*

“While the number of units sold followed the traditional trajectory, the lack of supply continues to put upward pressure on prices, which are holding strong and steadily increasing. Although there were 1,960 new listings in October, falling just under the 5-year average (1,974), it’s simply not enough. Inventory remains at a one-month supply for residential properties and 1.2 months for condominiums. The only way we will find balance in Ottawa’s market is to increase the housing stock exponentially.”

“Low inventory and a lack of suitable housing options restrict movement along the housing spectrum. Move-up buyers and downsizers have nowhere to go, so they stay in place, but we need that exchange of properties in the marketplace to free up supply for entry-level homebuyers,” Wright adds.

“Additionally, we have noticed a substantial increase in the number of rental transactions through the MLS® System, which could suggest that some of the properties have been purchased or held on to for investment purposes. This active rental market may be another contributing factor as to why there aren’t more properties coming onto the market for sale.”

OREB Members assisted clients with renting 4,012 properties since the beginning of the year compared to 2,829 at this time last year.

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.

Source: Ottawa Real Estate Board

For a more in depth look at your home please contact Steve Benson.

The Ottawa Resale Market Stats – September 2021

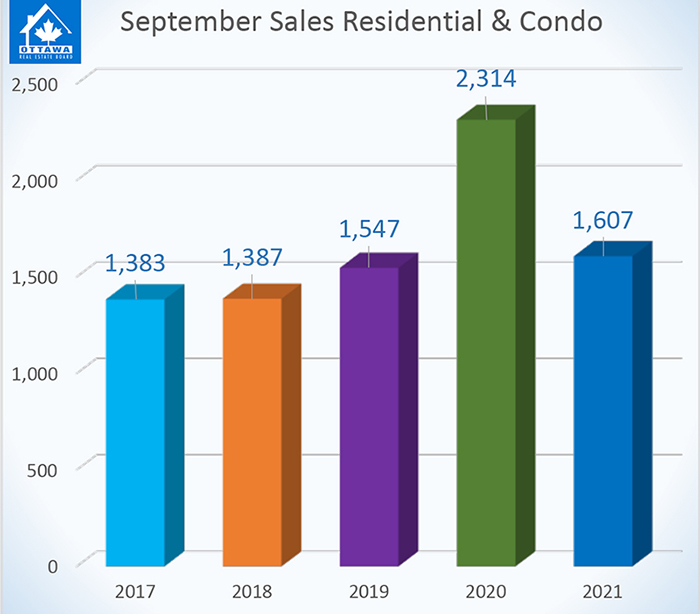

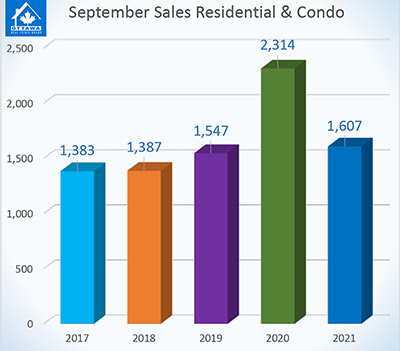

OTTAWA, October 5, 2021 – Members of the Ottawa Real Estate Board sold 1,607 residential properties in September through the Board’s Multiple Listing Service® System, compared with 2,314 in September 2020, a decrease of 31 per cent. September’s sales included 1,244 in the residential-property class, down 29 per cent from a year ago, and 363 in the condominium-property category, a decrease of 36 per cent from September 2020. The five-year average for total unit sales in September is 1,648.

“As per usual, the resale market in the early part of the month moved slowly due to the Labour Day holiday weekend and parents settling their children back into their school routines. Activity began to accelerate towards the end of the month, which is behaviour typical of the market in September,” states Ottawa Real Estate Board President Debra Wright.

“Although the statistics are showing a considerable year-over-year decrease in transactions, this anomaly is due to the shift of the 2020 market’s peak activity to the summer and fall months as a result of the initial Covid-19 lockdown last spring. If we look beyond the comparison to last year, the number of transactions in September was 4% higher than in 2019 (1,547) and 16% higher than 2018 (1,387),” she adds.

|

September’s average sale price for a condominium-class property was $425,362, an increase of 14 per cent from last year, while the average sale price for a residential-class property was $702,155, an increase of 13 per cent from a year ago. With year-to-date average sale prices at $720,492 for residential and $421,062 for condominiums, these values represent a 25 per cent and 17 percent increase over 2020, respectively.*

“House values are holding steady with a slight month-to-month increase (4-5%) in September and year-to-date average prices remaining strong for both residential and condo properties. Of course, these price escalations that we saw in the first quarter of 2021 and now recurring in September are inevitable given the supply challenges we have been experiencing for several years now combined with the unrelenting high demand,” Wright explains.

“While inventory has improved slightly from the pre-pandemic years (2017-2019), it is still the principal cause for concern with just over one month’s supply in the housing stock at this time. There were 2,252 new listings in September, an increase of 216 units over August; however, the number still falls beneath the five-year average and is much lower than this month in September 2020 (2,906).”

“With the election behind us, we hope the government will now concentrate on addressing supply issues and developing first-time homebuyer assistance touted in their reelection platform. Together with our REALTOR® Members and our provincial and federal counterparts, we will continue to advocate for availability and affordability in the Ottawa housing market and implore all three levels of government to implement effective measures to help all Canadians turn their homeownership dreams into reality,” Wright concludes.

OREB Members also assisted clients with renting 3,598 properties since the beginning of the year compared to 2,536 at this time last year.

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighborhood to neighborhood.

Source: Ottawa Real Estate Board

For a more in depth look at your home please contact Steve Benson.

The Ottawa Resale Market Stats – August 2021

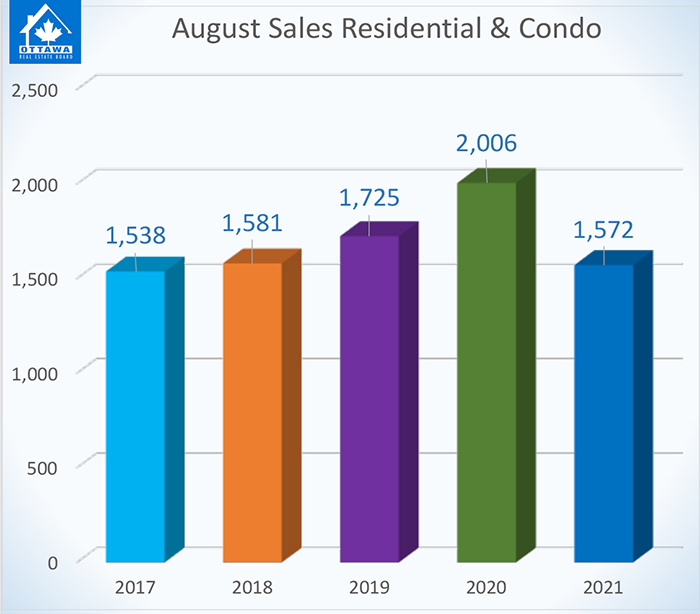

OTTAWA, September 3, 2021 Members of the Ottawa Real Estate Board sold 1,572 residential properties in August through the Board’s Multiple Listing Service® System, compared with 2,006 in August 2020, a decrease of 22 per cent. August’s sales included 1,175 in the residential-property class, down 25 per cent from a year ago, and 397 in the condominium property category, a decrease of 9 per cent from August 2020. The five year average for total unit sales in August is 1,684.

“August’s unit sales followed a trajectory typical of the resale market’s summer months with a considerable decline in transactions compared to the spring and 9% fewer sales than in July (1,724). The number of properties changing hands was on par with August 2017 and 2018 figures. The reason we see a sharp decrease compared to last year’s numbers is due to the first wave lockdown in spring 2020, which shifted that market’s peak to the summer and fall months,” states Ottawa Real Estate Board President Debra Wright.

“Year-to-date resales are at 14,728 and are 24% higher than this period in 2020, which clearly indicates we are in the midst of another strong year in the Ottawa market,” she adds.

August’s average sale price for a condominium-class property was $407,148, an increase of 6 per cent from last year, while the average sale price for a residential-class property was $674,449, an increase of 14 per cent from a year ago. With year-to-date average sale prices at $722,526 for residential and $420,654 for condominiums, these values represent a 27 per cent and 18 percent increase over 2020, respectively.*

“Supply continues to remain scarce, and that is the driving factor behind these price increases. New listings were down 400 units from July and 500 units from last August and below the 5-year average for the first time this year since February. Although inventory is approximately 5-6% higher than last year for both residential and condominium property classes, we are only at about 1.5 months’ worth of housing stock. To achieve a balanced market, we need 4-6.5 months’ supply of inventory,” Wright points out.

“We are pleased to see that housing affordability and the supply shortage have been a predominant part of election conversations and federal party platform pledges – which is a step in the right direction. We look forward to the collaboration between municipal, provincial, and federal governments to establish measures which will effectively address these fundamental barriers to homeownership for all Canadians who desire to own a home.”

OREB Members also assisted clients with renting 3,182 properties since the beginning of the year compared to 2,232 at this time last year.

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.

Source: Ottawa Real Estate Board

For a more in depth look at your home please contact Steve Benson.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link